Aerospace giant Rolls-Royce has nearly doubled its profits to £1.1 billion in the first half of the year, reflecting a successful turnaround strategy. Revenue also saw a notable increase, rising from £6.9 billion to £8.1 billion.

The significant profit growth is attributed to a series of strategic initiatives and cost-saving measures. Last year, Rolls-Royce, a FTSE 100 firm with major UK facilities in Filton and Derby, announced plans to cut 2,500 jobs globally to streamline operations.

Revised Forecasts and Dividend Reinstatement

The company has adjusted its full-year guidance upwards, forecasting an underlying operating profit of between £2.1 billion and £2.3 billion, and free cash flow of between £2.1 billion and £2.2 billion. Rolls-Royce has also reinstated its dividend.

Chief Executive Tufan Erginbilgic noted, “Our transformation of Rolls-Royce into a high-performing, competitive, resilient, and growing business is proceeding with pace and intensity. We are expanding the earnings and cash potential of the business in a challenging supply chain environment, which we are proactively managing. Our strong first-half results reflect the continued delivery of our strategic initiatives and a relentless focus on commercial optimisation and cost efficiencies.”

Future Outlook

Rolls-Royce has set mid-term targets of achieving an underlying operating profit of £2.5 billion to £2.8 billion and free cash flow of £2.8 billion to £3.1 billion. The company expects to realise over 75% of the profit improvement and more than 65% of the free cash flow enhancement by the end of 2024.

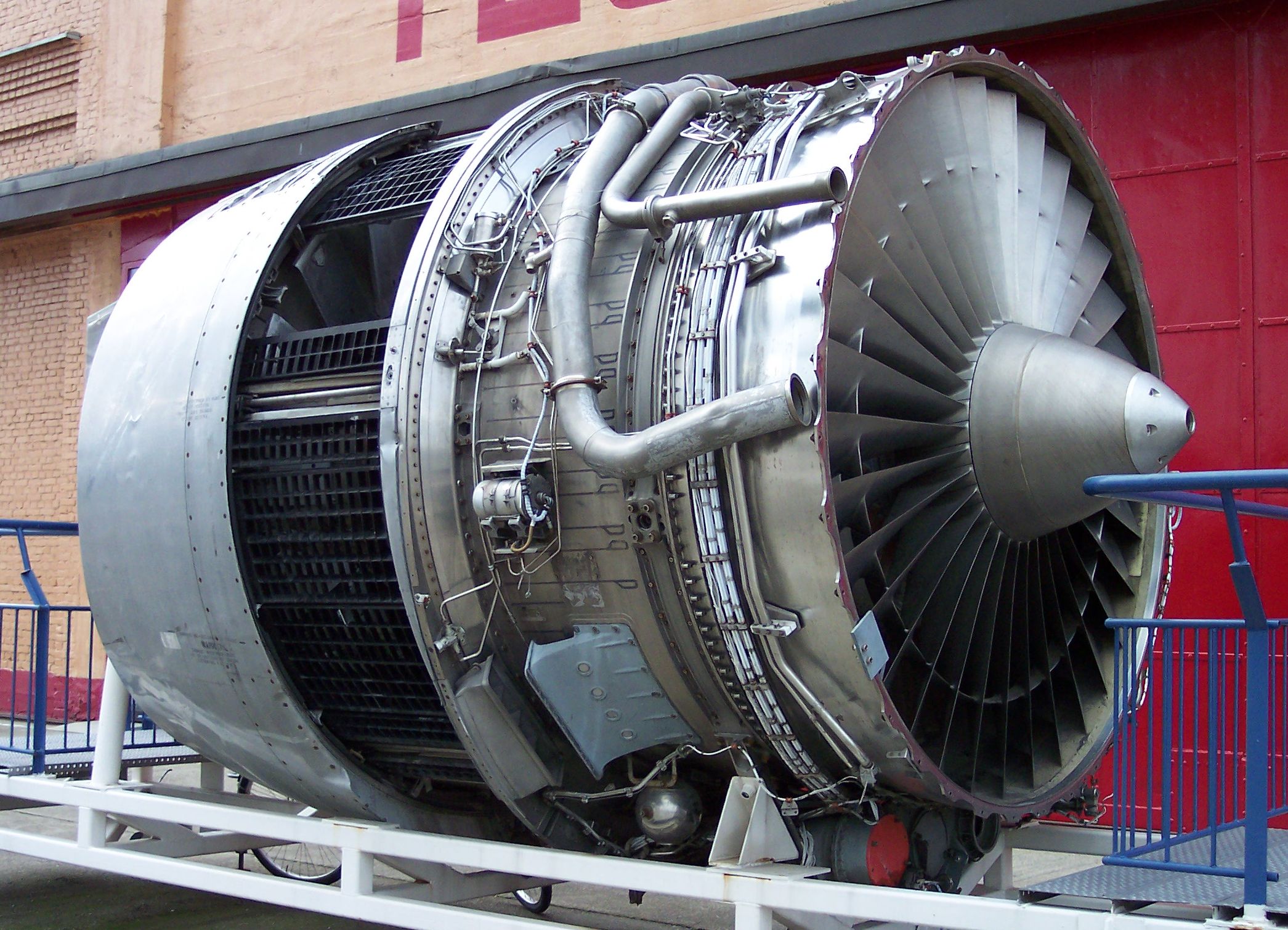

Having been significantly impacted by the Covid-19 pandemic, Rolls-Royce has been working diligently to recover and strengthen its financial position. The firm produces engines for some of the world’s largest commercial aircraft and employs tens of thousands globally.

4o mini